Please refer to important disclosures at the end of this report

1

Reliance Industries Ltd. (RIL) is India’s largest company with a dominant presence

in Refining, Petrochemicals, Telecom and Retail businesses. RIL has built up a

dominant telecom business and has already attained market leader status with

38.75 cr. subscribers at the end of Q4FY20. The company has also built a very

strong retail business which is the largest organized retailing company in India.

Refining and petrochemicals business would be a stable low growth business for

RIL going forward.

We believe that the Telecom business will witness robust growth over next few

years due to tariff hikes and shift of subscribers from Vodafone Idea to other

telecom players. The retail business too would be a key value driver for the

company and would now also look at leveraging on technology of Jio platforms

in order to expand it’s model to online from being a pure offline player.

The Company has recently been monetizing it’s stake in JIO Platforms which is the

digital arm of the company and also the holding company for the telecom

business. The company has so far sold 14.8% stake in JIO Platforms for a total

consideration of ` 67,195 cr. to marquee investors like Facebook, Silver lake,

General Atlantic and Vista. The consideration received by the company for it’s

stake in JIO Platforms along with the proceeds of the right issue will be used to

repay debt.

Outlook & Recommendation: The Company is offering shares to existing investors

in the ratio of 1:15 at a price of ` 1,257 per share out of which 25% needs to be

paid on application while 25% would need to be paid in May 2021 and balance

50% in November 2021. We are positive on the future prospects of the company

on the back of strong traction in digital and retail business and currently have a

BUY rating on the stock with a SOTP based target price of ` 1,748. We would

therefore recommend investors to SUBSCRIBE to the rights issue.

Key Financials (Standalone)

Y/E March (` cr)

FY19

FY20

FY21E

FY22E

Net Sales

3,85,501

3,50,880

3,73,215

4,57,539

% chg

32.9%

-9.0%

6.4%

22.6%

Net Profit

35,163

30,903

30,272

37,510

% chg

4.6%

-12.1%

-2.0%

23.9%

EBITDA (%)

15.3%

14.8%

13.8%

13.3%

EPS (Rs)

55.5

48.8

47.8

59.2

P/E (x)

25.4

28.9

29.5

23.8

P/BV (x)

2.2

2.0

1.9

1.9

RoE (%)

8.7%

8.4%

6.4%

7.8%

RoCE (%)

10.5%

9.2%

8.4%

10.0%

EV/EBITDA

29.4

29.1

34.7

29.4

EV/Sales

3.2

3.7

4.8

3.9

Source: Company, Angel Research; Note: Valuation ratios based at closing price for 19

th

May

2020.

SUBSCRIBE

Issue Open: May 20, 2020

Issue Close: June 03, 2020

Stock Info

Sector Diversified

Market Cap (` cr) 892,626

52 Week High / Low 1603/867

Face Value (`) 10

BSE Sensex 30,196

Nifty 8,879

Reuters Code RELI.NS

Bloomberg Code RIL.IN

Shareholding Pattern (%)

Promoters 48.9

MF / Banks / Indian Fls

13.5

FII / NRIs / OCBs 23.5

Indian Public / Others 14.1

Issue size (amt): ` 53,125cr

Offer Price ` 1,257

Post Eq. Paid up Capital: ` 6,766cr

Present Eq. Paid up Capital: ` 6,339cr

Rights Offer: 46.26cr Shares

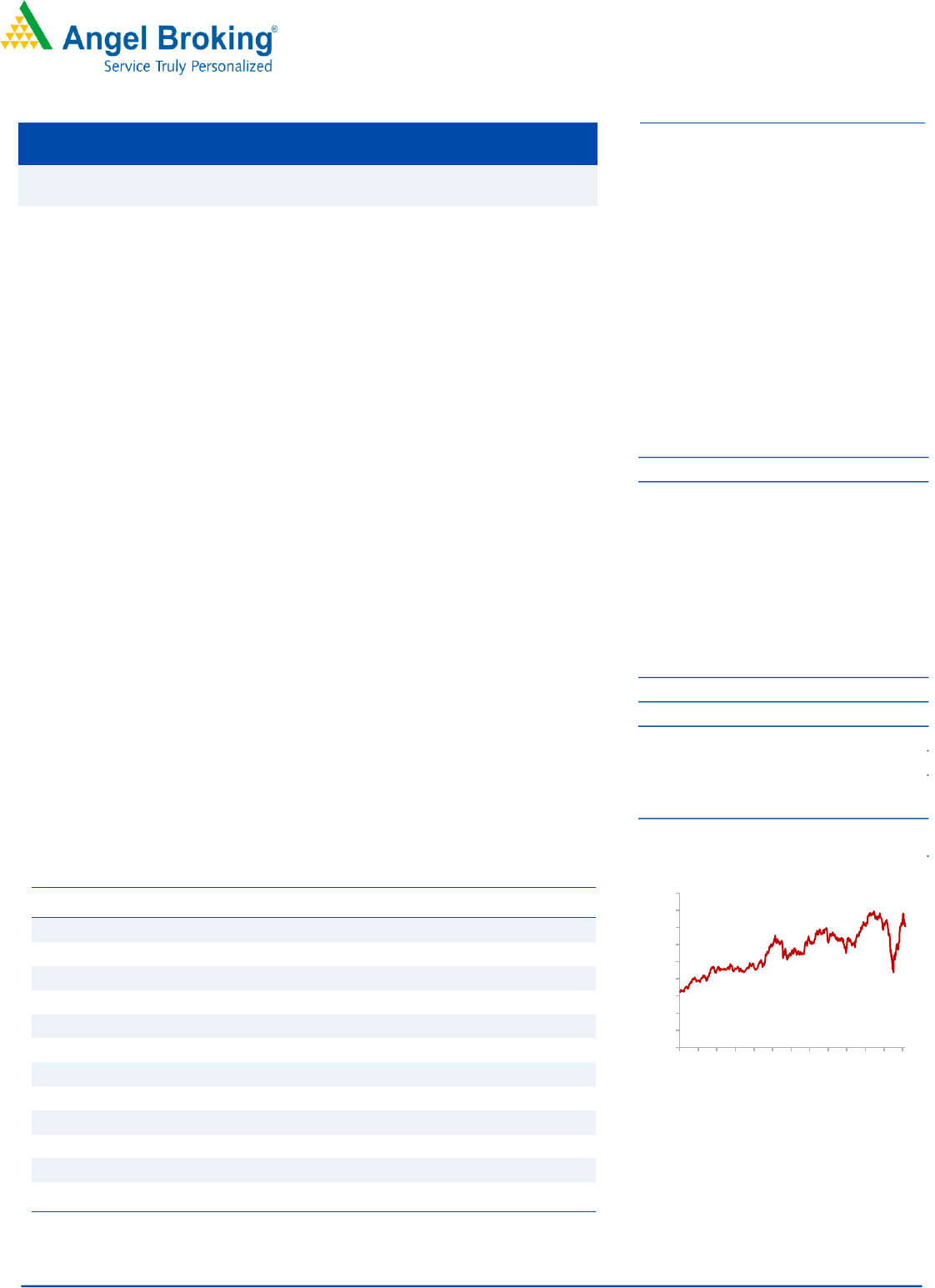

-

200

400

600

800

1,000

1,200

1,400

1,600

1,800

May-17

Aug-17

Nov-17

Feb-18

May-18

Aug-18

Nov-18

Feb-19

May-19

Aug-19

Nov-19

Feb-20

May-20

RELIANCE INDUSTRIES LTD. (RIL)

Right Issue | Diversified

May 20, 2020

Reliance Industries Limited | Rights Issue Note

May 20, 20

2

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National

Commodity & Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and

Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered

entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164.

Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities

Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public offering of securities of

the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National

Commodity & Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and

Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered

entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164.

Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities

Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public offering of securities of

the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information..

Ratings (Based on Expected Returns: Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%)

Over 12 months investment period) Reduce (-5% to -15%) Sell (< -15%)

Hold (Fresh purchase not recommended)